Influencers are changing how the world talks about money.

From TikTok clips on credit scores to Instagram threads about financial independence, creators now lead the conversation on personal finances. And people are listening.

But influencer marketing for finance isn’t as simple as e-commerce.

Influence comes with legal strings …

If a social media influencer shares financial advice or promotes a product, there’s a web of compliance rules to follow.

Let’s take a closer look at why this matters, what the law says, and how to build a compliant strategy that still converts.

Why influencer compliance matters more than ever

The influencer market is booming. Why? Because it gets results.

60% of marketers say influencer-generated content (IGC) performs better than conventional creatives. Even better, 98% of industry leaders say it generates more return on investment (ROI) in comparison to traditional digital ads.

This is because it feels authentic, so it builds trust and drives action. It’s also a great way to explain complex concepts to everyday people using household names they trust.

But while it’s a good marketing tactic, financial influencer relationships also invite scrutiny.

Regulators don’t treat a finance creator’s post like an ordinary brand shoutout. They see it as an endorsement.

They require that all promotions be conducted with clear disclosures and honest representation of any sponsorships or incentives. Skipping these obligations can trigger significant fines, legal action, and reputational damage.

Just ask Kim Kardashian.

In 2022, she paid a $1.26 million fine to the SEC for promoting a crypto token on Instagram without clearly disclosing payment.

What the law says: FTC, FINRA & SEC

Multiple regulators govern financial influencer marketing. And each has its own rules.

Here’s what you need to know to stay on the right side of the law.

FTC: Be honest, be clear

The Federal Trade Commission (FTC) requires all social media users to disclose any material connection to a brand. This speaks directly to content creators.

Whenever an influencer receives payment or gifts in exchange for a post, that relationship needs to be disclosed.

Mentioning the disclosure in the caption or comments won’t work. Hashtags like #ad or #sponsored should be integrated visibly in the content itself, not hidden out of sight.

Additionally, an influencer must use the product and speak openly about it. No exaggerating testimonials to sound better than reality.

This applies across all social media platforms and content types, from Reels and TikToks to YouTube Shorts. If influencers are promoting your financial products, transparency and honesty are vital.

FINRA: Document everything

Let’s look at the Financial Industry Regulatory Authority (FINRA). For regulated firms, FINRA treats influencer content as official business communication.

This means:

You’re responsible for supervising any social media usage tied to your brand.

You’re responsible for sharing promotional content that is balanced and clear.

You must store the content for a minimum of three years.

If a creator recommends your investment platform or retirement tool, FINRA expects the same compliance you’d apply to a brochure.

SEC: No hype, no hiding

Now to the US Securities and Exchange Commission’s (SEC) marketing rule. The SEC expects financial advisors or firms to treat creator endorsements as if they were official advertisements.

The rule says:

No cherry-picking performance stats or promising guaranteed returns

You can’t use “ineligible” individuals (like someone previously barred)

The influencer must clearly indicate any affiliation or partnership they have with the brand.

Compensation must be clear

9 Strategies to Build an Influencer Strategy That’s Clear and Compliant

In finance, a successful influencer campaign starts with transparency. And this clarity fosters trust, which in turn leads to conversions.

Here are nine tactics to help you stay compliant without killing your creative edge.

1. Pick Influencers with a Background in Finance

Not every content creator can speak credibly about complex financial concepts.

Select influencers who have a deep understanding of financial markets and financial planning. They don’t have to have qualifications. Go for influencers who have lived experience navigating money stress.

And look for more than follower count. Prioritize audience trust and proven understanding of financial content.

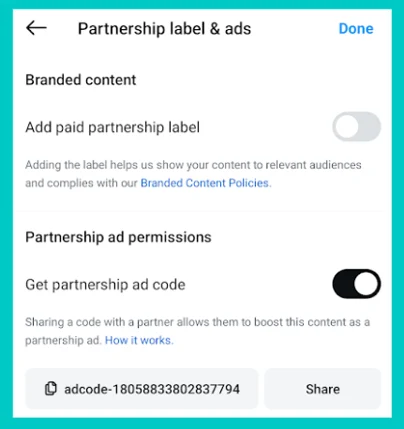

2. Build Disclosures into the Content, Not the Caption

The rules are indisputable. Influencers must openly declare any gifts or compensation they receive in exchange for endorsements.

Influencers also must not hide their disclosures. In fact, since 2023, the FTC has required disclosures to be included in the video itself.

To guarantee clear communication:

Include a verbal statement in the video itself—such as “This video is sponsored.”

Check the option for “paid partnership” when posting

Add hashtags to the caption

Display on-screen tags

Image Source: Statusphere

Image Source: Statusphere

Remember, you’re covering sensitive topics, such as investment advice or retirement savings. For people to make informed decisions about their finances, they need to be aware of any potential biases.

These strategies clarify sponsorship and stop you from misleading audiences with ads disguised as neutral information.

3. Focus on Educational over Promotional Content

In the finance space, valuable informational content outperforms hype.

Partner with creators who share tools, comparisons, or personal stories — not “get rich quick” schemes.

When someone demonstrates how they rebuilt their credit score or utilizes a budgeting app, this advice is actionable.

Hands-on help resonates with your audience and stays within compliance boundaries.

4. Balance Benefits with Risks

If you promote a product that helps with financial empowerment — like a credit card or savings account — your influencer must also mention any potential downsides.

Ignoring risk is a one-way ticket to regulatory scrutiny, as it can be both harmful and predatory.

Imagine someone takes out a 5000 personal loan with high interest rates and can’t repay it. This could seriously impact their credit score and financial stability.

Failing to highlight risks can mislead vulnerable users into thinking a financial product is a guaranteed fix.

It’s dangerous and deceptive.

When someone’s in financial trouble, even well-meaning content can push them toward decisions that could intensify their situation. Or worse…

Take the tragic case of Alex Kearns.

While not an influencer case per se, lawsuits alleged that the Robinhood app used “aggressive tactics and strategy to lure inexperienced and unsophisticated investors”. The trading app also failed to properly explain the risks of complex options trading.

His death sparked national outrage and a call for stricter measures on how financial platforms communicate risks through advertising.

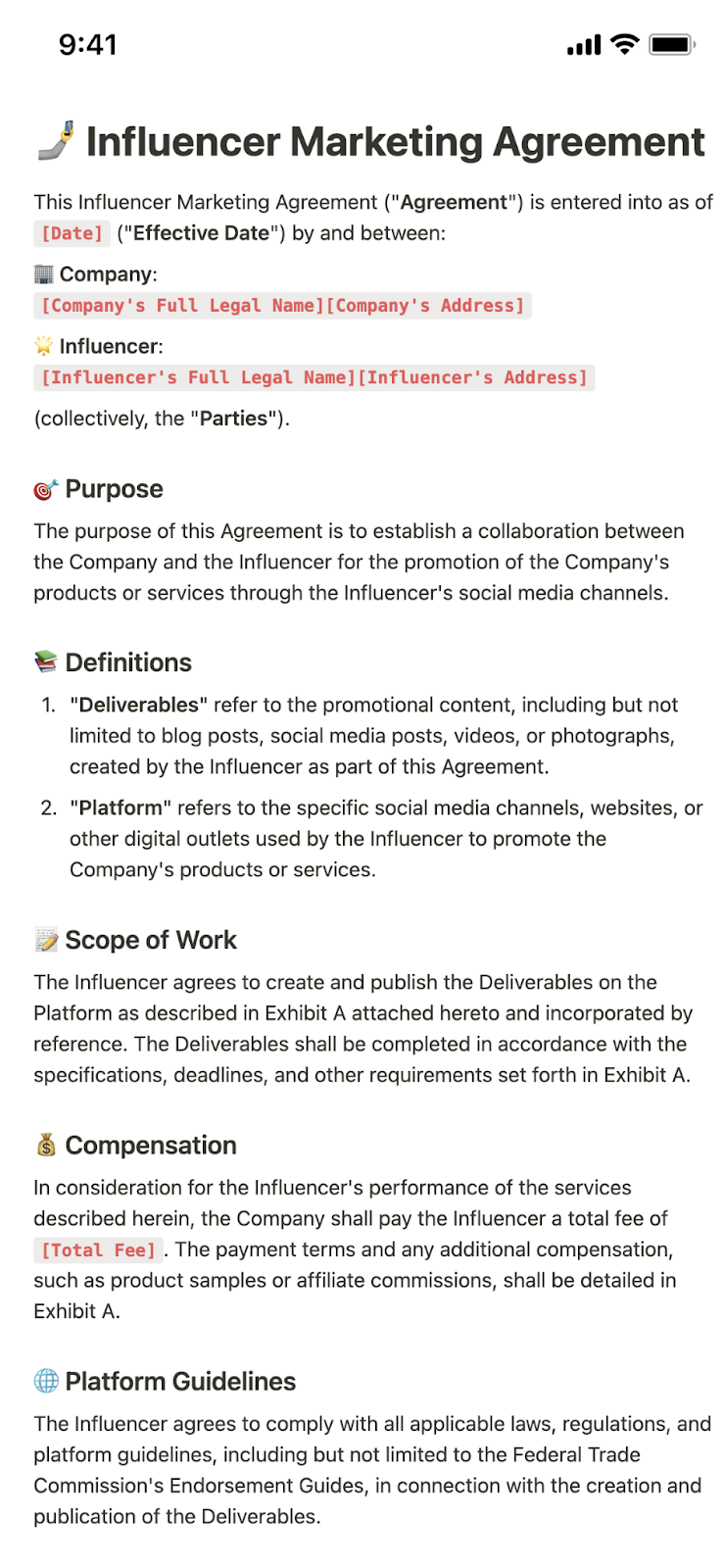

5. Use Contracts — And Not Just For Payment

Influencer agreements aren’t just for paid partnerships.

Even if you’re gifting a product, offering a discount code, or giving early access to a service, you still need a contract that outlines compliance responsibilities.

Image Source: Notion

Image Source: Notion

Every agreement should cover:

Language restrictions (no promises of “guaranteed returns”)

Guidelines on wording claims

Content approval workflows

Disclosure requirements

6. Pay Influencers the Right Way — Securely and Transparently

Influencer payments aren’t just a logistical detail—they’re a compliance requirement. Compensation must be disclosed and traceable. That’s why financial brands should avoid informal methods like cash transfers, peer-to-peer apps, or buried expense lines. These raise red flags for regulators and make it difficult to document relationships.

Instead, use secure, trackable payment methods that support compliance, budgeting, and audit readiness.

One smart solution is to issue secure virtual cards through finance automation platforms. With virtual cards, you can:

Maintain clean financial records for audits or internal reviews

Categorize payments by campaign or product line

Avoid reimbursements and manual tracking

Set spending limits for individual creators

These tools don’t just streamline operations—they also ensure every dollar paid to a creator is fully documented and easy to disclose.

Ensure the influencer agreement reflects these payment details. Include the amount, timing, and method of compensation, along with disclosure obligations tied to payment.

When in doubt, assume regulators are watching. Because they are. Having a secure, transparent payment trail protects both your brand and your partners. Consider integrating tools like a coworking space app to manage influencer collaborations and streamline campaign logistics alongside secure payments.

7. Train Your Influencers Like Internal Staff

Start every partnership with a short onboarding session. Training sets the tone for how you expect creators to represent your brand in the financial space.

Why? Because finance isn’t like fashion or beauty. Sharing financial content carries higher stakes.

One misstep can lead to fines, reputational damage, or regulatory investigations.

Your training should cover:

Language to avoid (e.g., “guaranteed return,” “risk-free”)

Real examples of compliant vs. non-compliant content

What counts as a paid endorsement or testimonial

The basics of FTC, SEC, and FINRA rules

Help them understand the “why” behind the rules. This results in safer content and stronger partnerships that consistently hit the mark without compromising compliance.

8. Monitor Every Post and Archive It All

Once content goes live, track edits, comments, audience response, and changes to social media platform policies.

Archive everything, especially if the influencer updates or deletes content.

This helps you cover yourself in case something goes awry. But more than that, it’s the law.

FINRA and the SEC expect you to record your marketing efforts, including influencer marketing.

9. Know when Creators Shouldn’t Give Advice

Influencers should never guarantee performance, offer individualized financial advice, or suggest they’re a licensed advisor if they’re not.

This means no “double your money” language, no direct recommendations to buy specific stocks, and no posing as a financial advisor. Ever.

Wrap Up

Influencer marketing can help you grow quickly in the financial space. However, you must follow the rules.

Treat social media content like regulated communication. Select suitable creators, be transparent about potential biases, and prioritize education over clickbait.

Get this wrong, and you face fines, PR crises, or worse.

Get it right, and you’ll build campaigns that scale trust and impact.